Sustainable Investment

Bioenergy

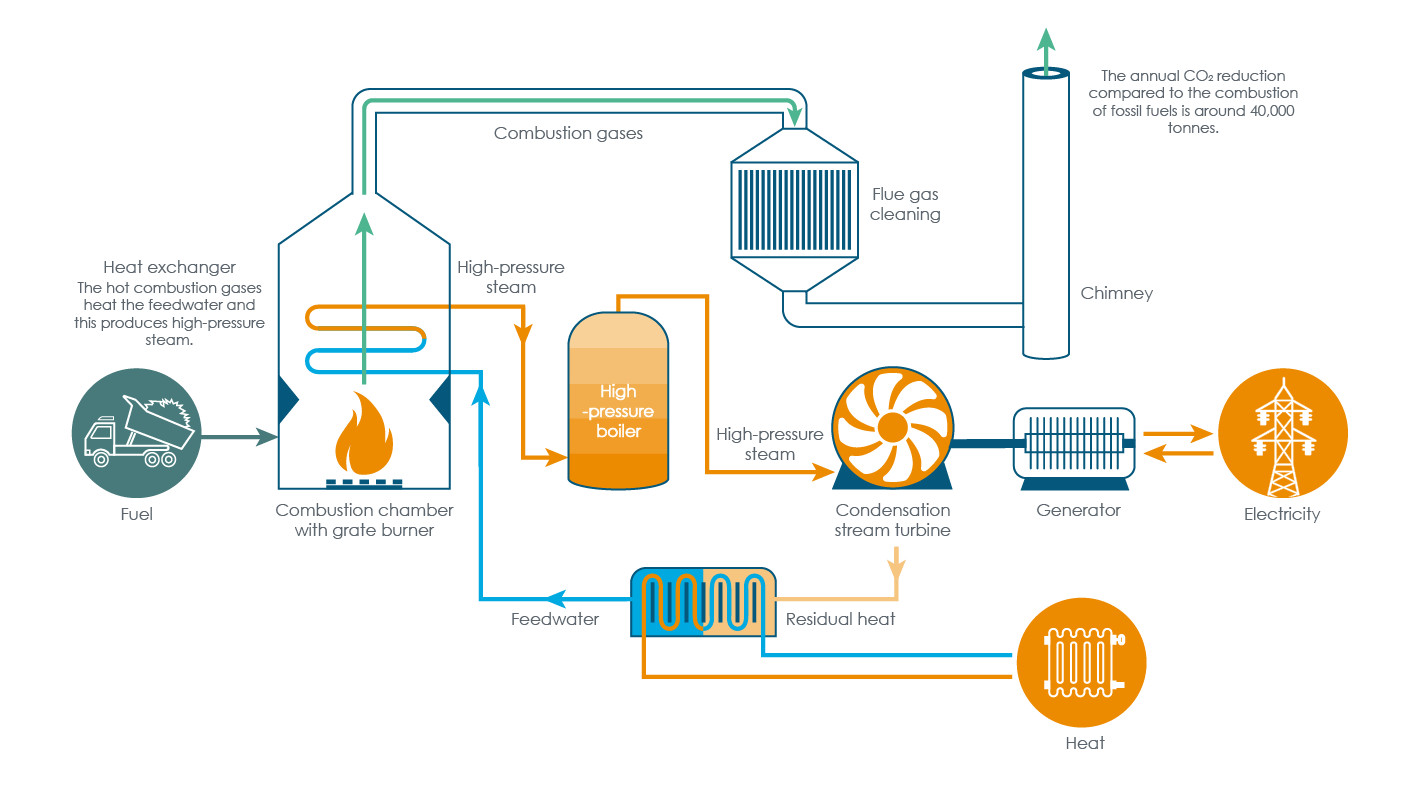

Bioenergy is an umbrella term given to technologies that produce renewable energy from recently living organic materials known as biomass. This can be used to make transportation fuels, heat, and electricity.