The publication of two long awaited government reports offers encouraging news for investors in renewable energy.

Last week saw the release of the Waste Review and the Anaerobic Digestion Strategy, demonstrating the government’s ongoing commitment to sustainable consumption. The Waste Review includes a range of pledges that focus on waste prevention, moving the UK towards a “zero waste economy” through re-use, recycling and recovery. A consultation on banning wood waste from landfill is also planned.

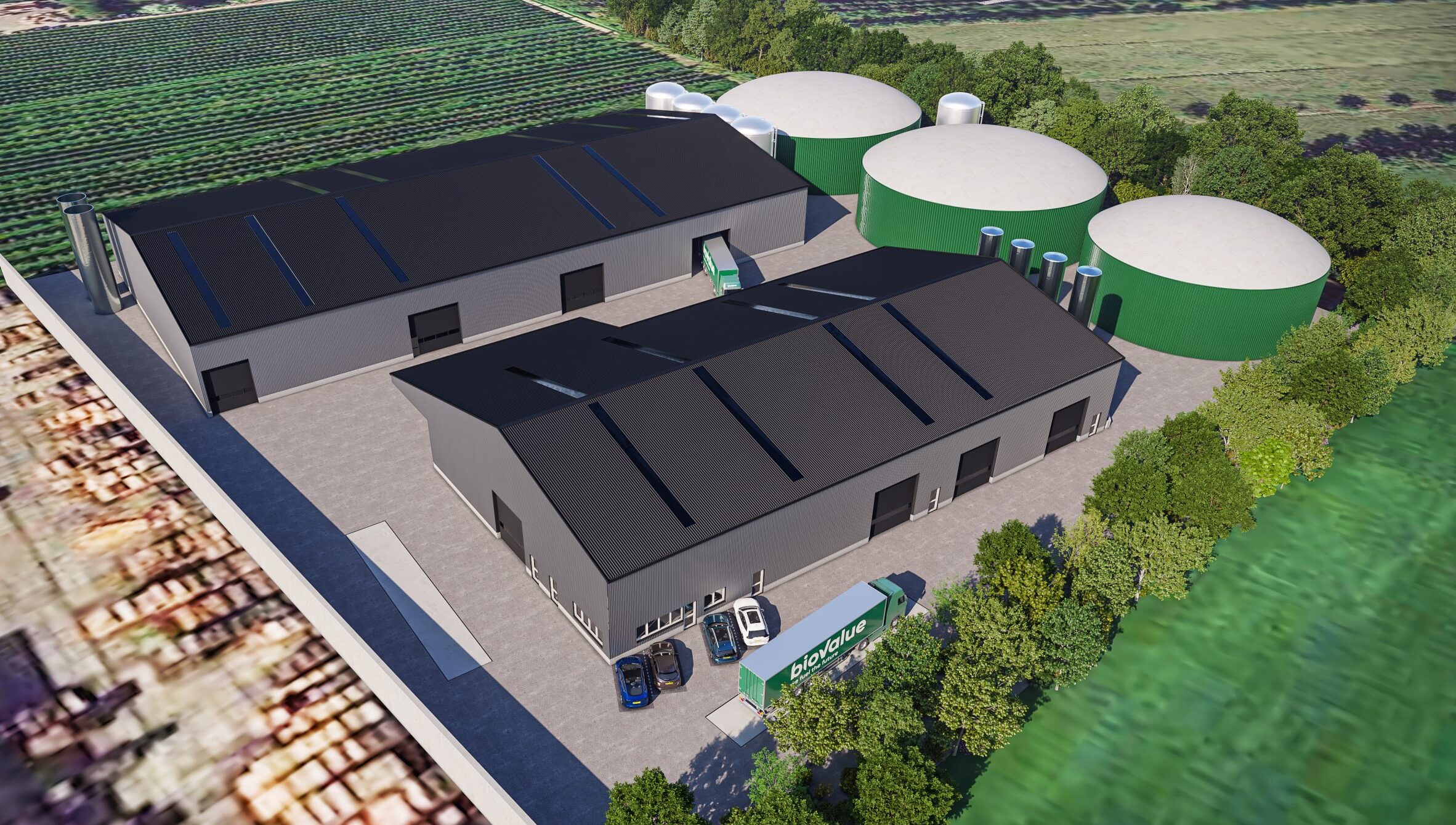

Working alongside the Waste Review, DEFRA’s Anaerobic Digestion Strategy outlines the practical application of the coalition’s pledges, with a policy drive to achieve a greener economy by increasing energy from waste through Anaerobic Digestion (AD). The report suggests a considerable increase in Anaerobic Digestion facilities over the coming years compared to the current market size. Mike Dunn, Iona Capital Partner, reviewed the strategy saying:

“Iona Capital has a strong record of supporting Anaerobic Digestion technology through funding and management of the Iona Capital Environmental VCT. We are encouraged by the report and specifically the implied commitment to use the Renewables Obligation Certificates and Feed In Tariff schemes to target development of this market.

We look forward to future publications referred to in this report, which will give a clearer insight into the application of these schemes against a backdrop of expanding the market capacity.”

Anaerobic Digestion Strategy findings at a glance:

- A number of sources suggest that per annum approximately 7 Mt11 of food waste is sent to landfill.

- That UK agriculture produces roughly 90 Mt12 of slurry and manures per year

- That potentially by 2020 a reasonable expectation for England could be in the range of 5 Mt of food – waste with in the region of 20-60 Mt of animal waste.

- ROC’s and FITS reviews are being conducted against a backdrop of developing the market capacity.

- That the Government has agreed that WRAP will set up a new loan fund to help stimulate investment in additional AD infrastructure. A total of £10m over 4 years will be made available to provide debt finance to stimulate investment in additional AD capacity

In-depth reading: