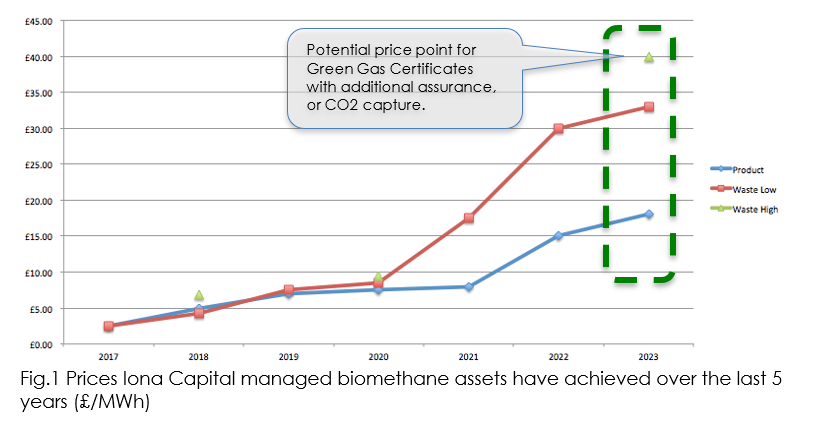

The last five years has seen a significant increase in demand for Green Gas Certificates across northern Europe as more companies and utilities seek to decarbonise both heat and power provision by making use of offsets. Green Gas Certificates remain the only practical solution for the decarbonisation of heat provision, particularly for organisations with legacy or transitional infrastructure in the form of CHPs and boilers, or the requirement for higher temperature process heat. In 2014 when Iona commissioned its first Gas to Grid AD plant it was selling its Green Gas certificates at £2.5/ MWh into an emerging market. This contrasts to a market today (see below) where Iona is achieving prices in excess of £30/MWh.

This increase in demand has been coupled with a slowdown in the growth of new biomethane plants across Europe. This has been driven by changes in the government subsidy schemes, and also in the UK by the slow adaptation of the national gas grid infrastructure to the requirement to inject gas into the intermediate and low-pressure distribution systems. Whilst The new EU biomethane growth plan introduced in 2022 is expected to lead to a significant expansion in new sites the industry remains constrained by sources of waste feedstock and grid connectivity.

Kanadevia Inova Capital Ltd.

123 Pall Mall

London SW1Y 5EA

Tel: +44(0) 20 7064 3300