Swiss-based greentech company announces its first investment in the country’s biogas sector, paving the way for the development of further projects across Benelux.

Zurich, Switzerland — Kanadevia Inova, a global leader in solutions for the energy transition and circular economy, announces its first investment in the Dutch biomethane market, made through its recently acquired subsidiary, Iona Capital (“Iona”).

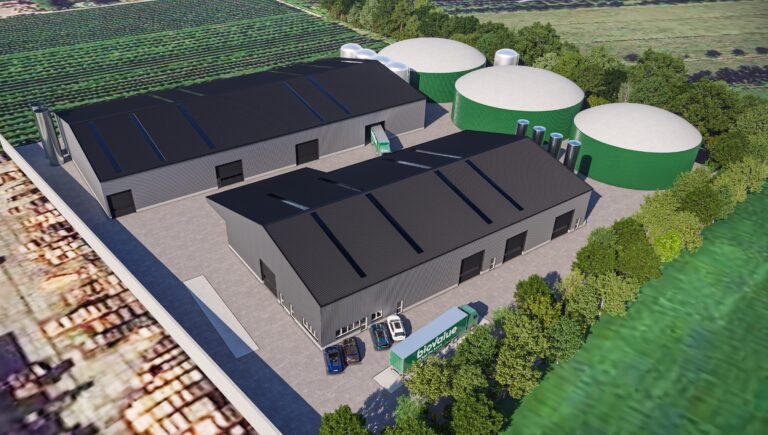

The deal sees Iona take a majority stake in Groengas Cothen B.V. (“Cothen”), a 100GWh per annum biomethane facility in the central Wijk bij Duurstede municipality, and paves the way for the development of further assets through plant’s hitherto owner, BioValue B.V. (“BioValue”), to develop assets across the Netherlands and wider Benelux region.

BioValue is a leading developer, owner, constructor and operator of anaerobic digesters in the Netherlands. Founded by Ids Schaap, it has a portfolio of four operational plants and a significant pipeline of assets in construction and development phase. The deal with Iona provides a framework

for investment in BioValue and its development assets.

Iona and Kanadevia Inova’s backing of BioValue is underpinned by the investment in the Cothen facility, which is the latest plant in commissioning in the BioValue portfolio. The plant will be fed on manures and residues, and has an output capacity of 100GWh per annum with planned biogenic CO2 capture.

Last month Kanadevia Inova acquired Iona Capital and 11 Iona-managed biogas assets, with a view to increasing biogas and biomethane production in Europe and North America. The acquisition of Cothen is a major step forward in this strategy.

Alex Todhunter, Investment Director at Iona Capital said “This is a landmark step for Iona Capital, with its first investment in the Dutch biomethane market, a key growth sector within the European Union. We are delighted to back the BioValue platform and team, who have a strong operational track record as well as capability to develop and build significant greenfield assets.”

Keith Carr, Executive Vice President Asset Management at Kanadevia Inova, welcomed the acquisition as “a strong signal of our intentions to develop biomethane assets in a strategic market.”

“We see this deal as a highly promising bridgehead into Europe’s biomethane market, and a further step towards realizing our vision of becoming a global green utility in the waste infrastructure space,” he said.

Ids Schaap, founder and CEO of BioValue said “Iona, as an experienced investor and operator in biogas, are an ideal new partner as we look to grow the BioValue business. The deal strengthens our balance sheet and ability to develop larger assets whilst complementing our own in-house expertise with the Iona and wider Kanadevia Inova teams.”

Norton Rose provided legal advice, RSM provided tax advice and SLR and eKwadraat provided technical advice to Iona.

Stek provided legal advice, EY provided financial and tax advice, and Royal Haskoning provided technical advice to BioValue.

Kanadevia Inova Capital Ltd.

123 Pall Mall

London SW1Y 5EA

Tel: +44(0) 20 7064 3300