Osborne’s Autumn Statement today revealed new measures which positively affect Iona’s investment strategy.

One of the main themes for Iona that came out from the announcement is with regards to additional funding ,which is to be provided in civil and environmental infrastructure projects. In particular the Government has established a further £100m of funding specifically targeting environmental infrastructure.

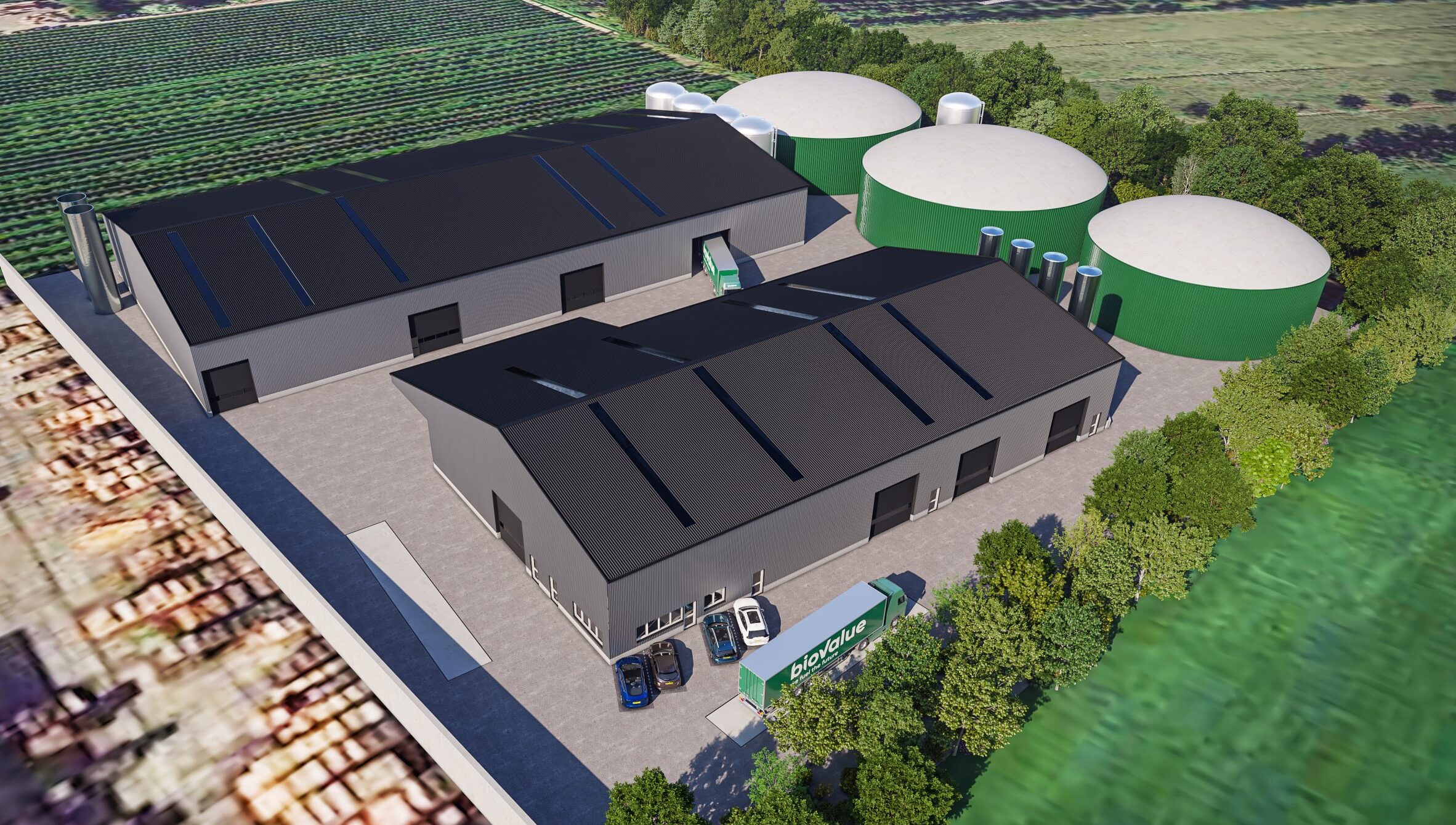

The waste to energy sector has already been well supported by the Government, with Anaerobic Digestion one of only two alternative energy technologies that still qualifies for the double subsidy of VCT tax relief and Feed in Tariffs.

It is perhaps no surprise that against this backdrop of rising taxes and the need to invest in environmental sectors that the investment case for Iona is stronger than ever. This is reflected in its growing deal pipeline.

The Chancellor also announced that the £1m annual investment limit that is applied to VCTs will be removed to reduce the administrative burdens on the funds. This is a big step towards removing the red tape, which is going to make investment more efficient and will benefit both shareholders and portfolio businesses. There is further consolidation of the industry anticipated, which is expected to provide further benefit to the industry also. Iona will report on this as it happens.

For further information, please do not hesitate to contact Iona Capital on 020 7306 3901.

Iona Capital is an environmental tax efficient fund manager and provides equity and subordinated debt into waste projects which have a renewable element. This includes the production of methane gas for conversion into electricity or heat and the recovery of recyclable materials. Iona develops strategic partnerships and uses sector-specific expertise and financial skills to achieve profitable growth for its investors who range from individuals to large local authority pension funds.