Iona Capital Newsletter September Issue

Welcome to Iona’s Newsletter. This edition focuses on the dramatic growth of ESG over recent years, and questions whether it will be sufficient to drive the level of behaviour change required to stay within the 2 degrees Celsius global warming target. It also provides an update of interesting news from the energy/environment sector and also from the Iona Capital team.

Iona News

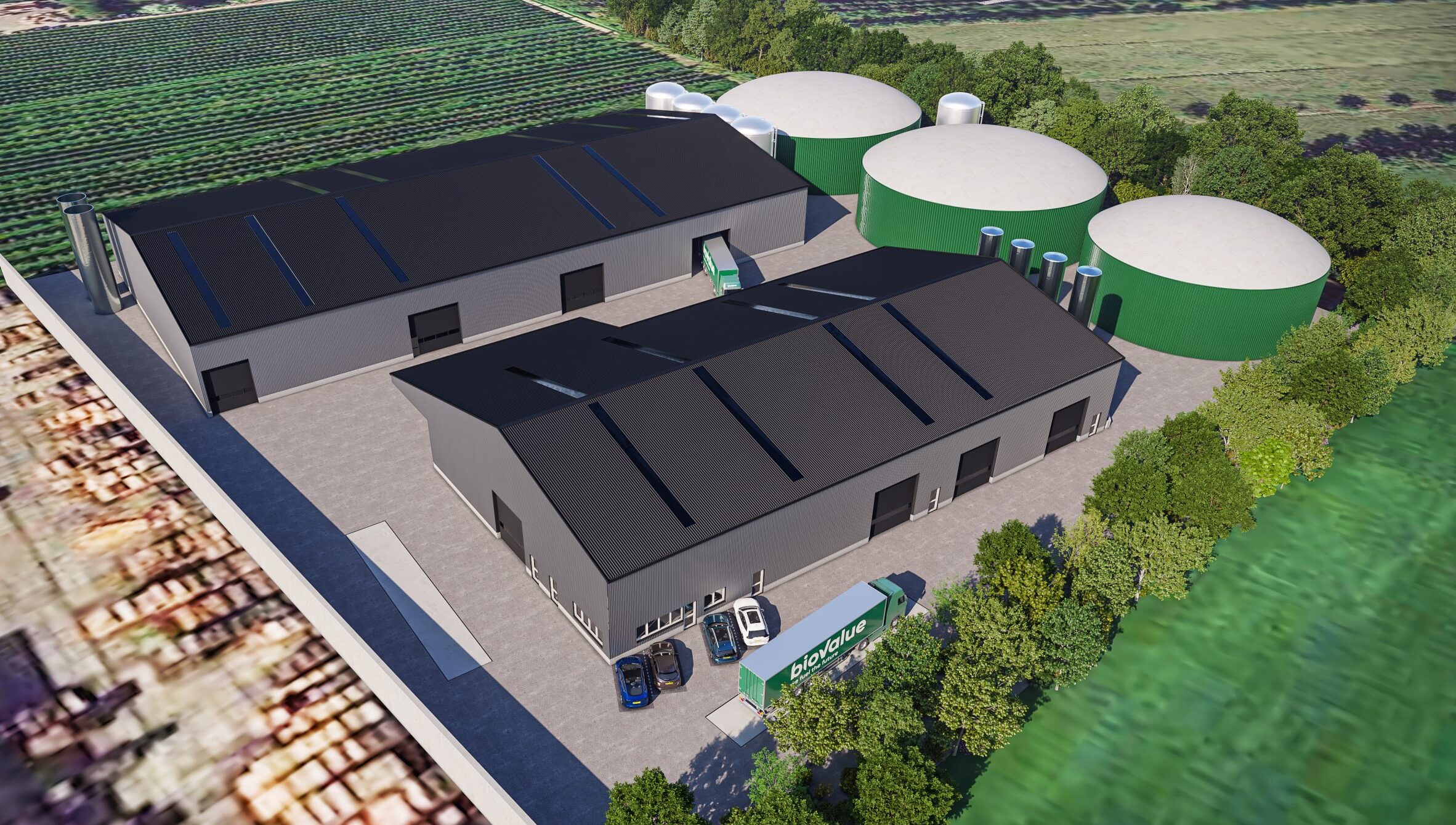

The restructuring of Advantage Biogas has now been successfully completed and Iona Capital’s operations subsidary will now focus exclusively on Iona assets. This has led to a strengthening of the Service on Demand and Reactive Maintenance Teams.

Aerospace Energy has now commissioned its 2 X 1.5 MW engines and is now producing low carbon heat and power to Mettis Aerospace, the leading manufacturer of precision forged and machined components for the aerospace industry through a dedicated private wire to its facility in Redditch, Worcestershire. The investment, which is from our [third] fund closed in November last year.

Data capture methods have been realigned to help further strengthen Iona’s ESG reporting obligations, in the wake of the company recently received an A rating from the UNPRI.

Notices

Nick Ross will be attending the Alt Assets Infrastructure Conference on the 1st of October.

Pascal Lamy former head of the WTO will be speaking at a private dinner hosted by Iona Capital on the 14th of November.

News & Interesting Publications

In the wake of climate change increasingly becoming a matter for daily headlines there has been a subsequent surge in a number of new sustainable markets, with the rise of the EV market being perhaps one of the most notable. In 2013 there were a mere 3,500 electric vehicles in the UK, with this number rising to 227,000 vehicles at the end of August 2019. Tesla has long been one of the market leaders in this sector, with its Model 3 being cited as the UK’s third favourite car in August as electric vehicle sales doubled in the past year.

The government has recently issued a press release stating that they intend to set up a £60m fund which specifically invests in reducing the amount of unnecessary plastic produced throughout the UK in order to help fight ‘the global battle against single use plastics’.

In other news there was an organised strike which spanned across the globe on Friday orchestrated by an array of different climate activist groups, in a bid to speak out against the rate at which human activity is intensifying climate change. Organisers estimated that around 100,000 people attended a rally in central London, while more than 20,000 were thought to have marched in Edinburgh and 10,000 in Brighton. In Belfast, organisers put the turnout at between 3,000 and 4,000, with young people taking over the Cornmarket area of the city centre and staging a “mass die-in”. The climate strikes were initially inspired by 16 year old Greta Thunberg’s individual protest against climate change in Sweden.

Thought of the week

Is ESG the Solution, or Part of the Problem?

As a thematic low carbon investor, Iona Capital has had a box seat during the development of responsible investment and ESG over the last 8 years. Whilst we see the growth of ESG as a positive development in focusing the minds of investors and companies on sustainability, we are increasingly concerned that it is often seen as a ‘no cost’ pathway to, inter alia, a low carbon future. We believe that governments, investors and corporates must look beyond ‘additive’ ESG measures towards more fundamental changes to the way our economies and businesses value, manage and tax energy and natural resources.

What is ESG?

Environmental, Social and Governance (ESG) refers to the three themes that are seen to drive the sustainability and ethical impact of business investment. It is based on the premise that ESG can leverage market forces to promote sustainability. It has become commonly accepted that by focusing on and measuring the performance of material ESG factors, investors and company executives can deliver improved future financial performance. Within the headline E, S, and G themes, there are a range of sub-factors that are generally grouped as follows:

- Environmental: Energy usage, GHG emissions, pollution, resource usage and efficiency etc.

- Social: Health & safety, diversity, working conditions, consumer protection, community engagement etc

- Governance: Management, shareholder protections, bribery & corruption, board independence etc.

ESG is often spoken of in the same breath as Socially Responsible Investment (SRI). However, SRI is primarily based on ethical and moral criteria and often uses negative screens (such as not investing in fossil fuels, alcohol or tobacco), whereas ESG investing is based on the critical assumption that by understanding and considering ESG factors, investors can enjoy a correlated and positive impact on financial performance/returns.

The Impact of ESG

Conventional wisdom was that pursuing ‘impact’ or ‘social’ investing would sacrifice financial returns. However, numerous studies (and indeed performance of sustainable funds and indices) have shown a positive correlation between companies’ ESG performance and their longer term financial performance. This has been a significant factor in the growth of ESG as investors have looked for ways to outperform markets. However, has ESG improved sustainability over the last twenty years? Taking a narrow look at global CO2 emissions, they are now 55% higher than in 1997 (the year of the Kyoto meeting). The last two years has even seen accelerating growth. Perhaps the most we can claim is that ESG may have slowed this growth rate – but it certainly hasn’t managed to reverse it! Part of the problem can be laid at the uneven implementation of ESG principles across all countries and sectors across the globe. However, we should also question whether ESG may be necessary, but not sufficient, to drive the transition to a sustainable global economy.

Is ESG a ‘Greenwish’ Problem?

An excellent recent article by Duncan Austin (https://preventablesurprises.com/wp-content/uploads/2019/07/2019-07-19-Greenwish-Essay.pdf) introduced the concept of ‘greenwish’. He argues that the well-intended efforts of ESG are lulling us to believe that it can make the necessary changes to make the world more sustainable. This ‘greenwish’ is masking and taking focus away from the more fundamental changes that are actually needed to make the transition. A Way Forward? Since the industrial revolution, capitalism has become the driver of global economic growth and development. The concept of maximising profit and shareholder value have become central to the way our market economies work. The major blind spot of these market-based economies is the measurement, pricing and incorporation of externalities. The very terminology, ‘externalities’, suggests that it sits outside of the capitalist model. Indeed, the environmental economist, Pavan Sukhdev, sees corporate externalities as “the biggest free lunch in the history of the universe” The value of these externalities and the ‘unpriced’ global ecosystem is central to the very concept of a sustainable economy – and yet we have relegated this to a second order issue behind financial performance. As long as ESG factors sit outside the core profit motive, and as a second class adjunct to financial measures, its impact will be limited. To begin to succeed, we need to move quickly towards a much mo

re comprehensive valuation of our global ecosystem and the associated externalities – and price these through meaningful environmental taxation, charges and regulation. This will drive changes to the current corporate and consumer behaviour. Unfortunately for free marketeers, this suggests bigger government and a curtailing of choice. More fundamentally however, we need to question the system itself – where financial profit has become so hard baked into its culture. We need to begin to formulate and reconfigure a new model at the collision point of environmentalism and capitalism.