Welcome to Iona’s sixth digest. This edition takes a look at the increasing momentum behind the climate change movement from governments, businesses and individuals, as well as the need for investors to select fund managers that can articulate clear execution strategies in these rapidly evolving markets. It also provides a summary of news from the energy/environment sector and the Iona Capital team.

Four recent newsworthy events highlight the accelerating momentum of the climate change movement. We have summarised each of these events below, together with an analysis of what they mean for investors investing into sustainable/low carbon funds.

Summary of the UK Committee on Climate Change report “Net Zero – The UK’s contribution to stopping global warming”

The UK Committee on Climate Change (CCC) published a report in May 2019 with the bold title “Net Zero – The UK’s contribution to stopping global warming”. The report laid out a comprehensive, challenging but achievable pathway for the UK to achieve zero carbon emissions by 2050. This is an important report, in that it lays out, how zero emissions can be achieved by a major industrialised economy in the middle of this century. It also recognises that all parts of the economy, including Government, businesses and consumers, must be engaged in order to achieve this goal.

Critically the report makes explicit comment that it is over to the UK Government to enact the appropriate policies to drive the low carbon transition. It is clear that the Government will have to use both carrot and stick to lead … in partnership with investors, businesses and communities to hit the Zero Emissions target. How the UK Government’s legislative programme responds to this report over the next 12 months will shape, to a significant degree, a range of risks and opportunities for UK investors over the next decade.

Report highlights include:

- The UK should set and vigorously pursue an ambitious target to reduce greenhouse gas emissions (GHGs) to ‘net-zero’ by 2050.

- A net-zero GHG target for 2050 would respond to the latest climate science and fully meet the UK’s obligations under the Paris Agreement.

- The target is achievable with known technologies, alongside improvements in people’s lives, and within an estimated resource cost of 1-2% of UK GDP p.a. to 2050.

- However, this is only possible if clear, stable and well-designed policies to reduce emissions further are introduced across the economy without delay. The report notes that current policy is insufficient for even the existing targets.

- Delivery must progress with far greater urgency than at present. Many current plans lack ambition, whereas others are proceeding too slowly.

For the full report head to: https://www.theccc.org.uk/publication/net-zero-the-uks-contribution-to-stopping-global-warming/

Investors are increasingly focused on climate risks and opportunities

As the number of signatories to the UN Principles for Responsible Investment (UNPRI) increased in 2018 by 21% to 2,232 (accounting for over $89 trillion in assets under management), it seems we are seeing increasing momentum in the shift in investor focus to ESG considerations, broader stakeholder capitalism and climate change. For example, the third largest US pension plan, the $207 billion New York State Common Retirement Fund (NYSCRF), recently convened the US’s first ever Decarbonization Advisory Panel (DAP). The panel’s report very clearly stated that: The DAP also stated that it believed that soft barriers, such as minimum investment values and percent ownership criteria, consultants, benchmarks and compensation structures needlessly limited the Fund’s ability to capitalise on and prepare for the low carbon transition. It further believed that the Fund would need to pursue modified or innovative processes to capitalise on climate-related opportunities at scale. This report succinctly restates the requirement for all investors to be forward thinking in their approach to identifying climate related risks and opportunities, and also more innovative in their approach to investment allocation, investment processes and criteria.

The panel’s report very clearly stated that:

- “Climate change poses significant risk to the Fund’s investment portfolio across equities, alternatives and credit, as most (if not all) do not currently adequately price climate-related risk.”

- “[Fund] managers and companies with deeply embedded and carefully analysed climate-related strategies, operations, metrics, governance and incentives will outperform the market…”

- “Global investment in clean energy and low carbon opportunities must increase three to five times current levels in order to stay within 2°C and 1.5°C warming respectively (the “investment gap”)”

- “Within the “investment gap” there exists significant opportunity for investors to capitalise on strategies that maximise resource efficiency in a variety of areas including, but not limited to energy, transportation, agriculture, buildings, circular economy and climate resilient infrastructure.”

BP Shareholders’ Overwhelmingly Vote For Greater Climate Disclosures

At BP’s AGM in Aberdeen on May 21st 2019, 99% of its shareholders voted for BP to make greater disclosures on its emissions and show how its investments and business strategy align with the Paris Climate Agreement. This follows climate related votes by Shell’s shareholders in 2018, and signals that shareholders are becoming increasingly activist on how companies must respond to climate change. This pressure is likely to keep increasing over time. We expect, therefore, to see companies across a range of sectors progressively and explicitly formulate strategies that address climate change as well as broader ESG considerations. Indeed, as outlined in the CCC report, decarbonisation of the UK depends heavily upon businesses becoming fully engaged with the problem at hand. As we have seen, for example, with the dramatic growth of corporate PPAs for renewable energy, this movement will see increasing interest from the commercial sector in participating in renewable energy and resource efficiency projects within their supply chain. Again, this trend will drive opportunities for investors willing to provide funding into this rapidly evolving space.

UK Concern Over Environment sees Significant Growth

A YouGov poll in June 2019 showed that public concern about the environment has soared to record levels in the UK following the recent Extinction Rebellion protests and the visit of Greta Thunberg. The environment is seen as being the third most pressing issue after Brexit and Health. A quarter (27%) of Britons now cite the environment in their top three issues facing the country, putting it behind only Brexit (67%) and health (32%).

Whilst this may be a temporary spike, the underlying trend is clear. The public are becoming more focused on climate change – and this will have an increasingly measurable impact on their behaviours and choices as consumers and voters. This, in turn, will drive very significant opportunities for investors in areas where both consumer demand and B2C strategies and offerings will respond over time.

Investors’ Approach to the Selection of Sustainable/Low Carbon Fund Managers

Against the backdrop of the crystallising macro trends above, the landscape of investors looking to deploy funds into low carbon assets is becoming increasingly complex and diverse. The nature of traditional infrastructure investment is changing as energy generation becomes more distributed, transport electrifies, heat decarbonises and consumer behaviour greens. To be successful in this evolving environment, investors are having to:

- Look at investment allocation, investment criteria, minimum investment size and processes to accommodate the changing investment landscape, and

- evaluate non-traditional fund managers’ abilities to:

- Articulate an investment strategy to take advantage of the emergent opportunities arising from the low carbon transition.

- Demonstrate technical understanding of key sub-sectors such as the waste market and corporate resource efficiency.

- Invest at smaller scale to match the nature of the market opportunity.

- Develop and structure transactions at pre-construction phase to extract superior returns.

- Understand and incorporate commercial counterparty risk as part of risk structuring.

- Be organised for ongoing management of investments in changing markets.

Given its clear focus and demonstrated track record, we believe that Iona Capital is well positioned to take advantage of the evolving markets and the emergent investment opportunities on behalf of its growing and increasingly enlightened investor base.

News & Interesting Publications

Environment Secretary Michael Gove has recently confirmed a ban on plastic straws, drinks’ stirrers, and plastic stemmed cotton buds in England following overwhelming public support for the move. Following an open consultation, the ban will come into force in April 2020. The ban will include exemptions to ensure that those with medical needs or a disability are able to continue to access plastic straws. For the Glastonbury festival fans, the ‘Gas Tower’ dance arena in the Shangri-La area will be created using waste collected in Cornwall, Devon and Somerset. Furthermore, Glastonbury has banned the sale of plastic bottles at this year’s festival which opens on 26 June. If you are looking to refresh your climate change arguments then Iona recommends looking up Fiona Harvey, the Environment Correspondent at the Guardian who has written a piece on reasons why climate change counter arguments don’t stack up: www.guardian.com/environment/2019/jun/05 There is another interesting article in the Economist, 1st June edition on Aviation BioFuels and why it won’t fly. The article suggests that is constrained by the amount of land required to grow the biofuels (even ignoring the technology challenges!).

Iona News

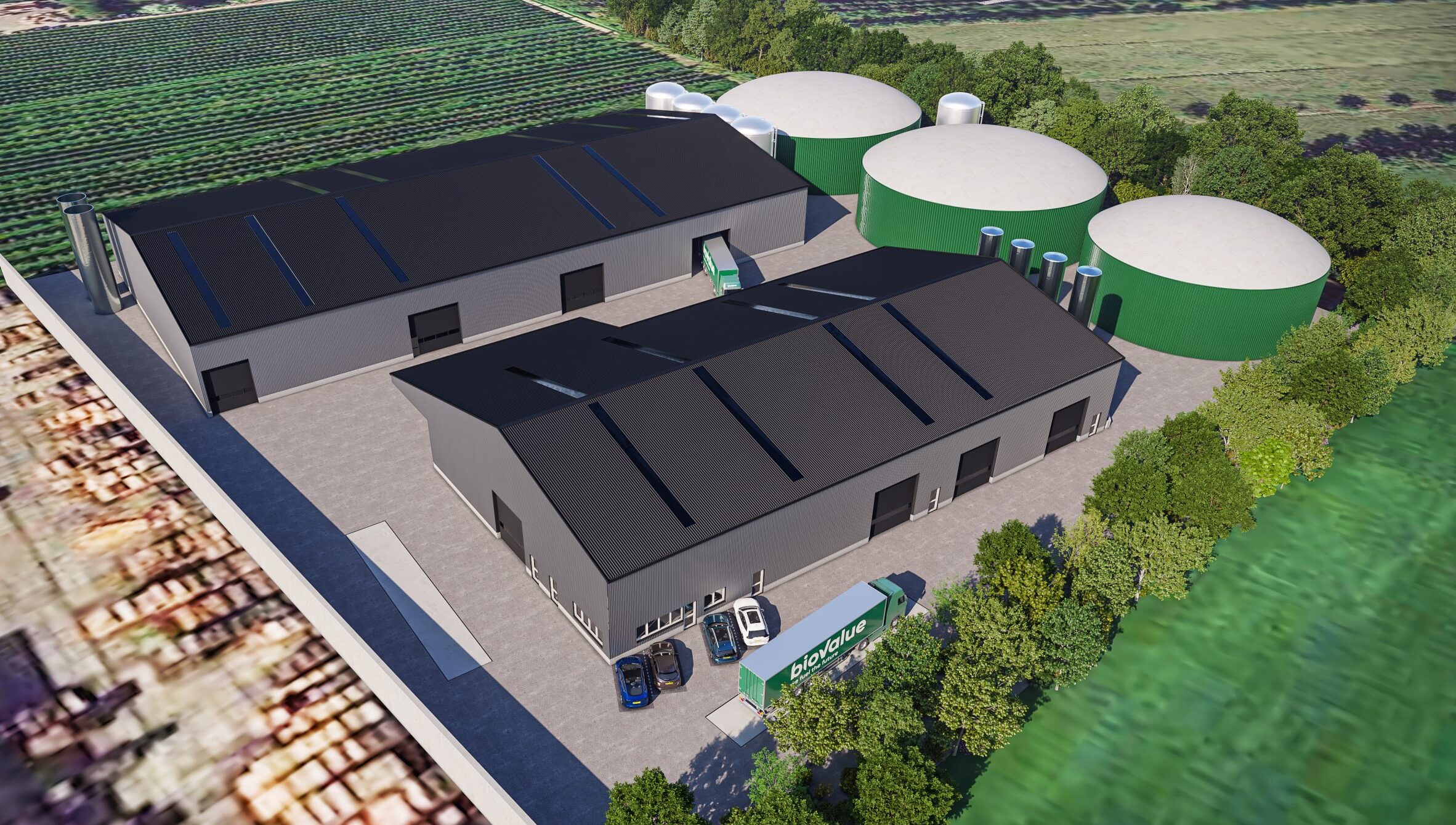

In a flurry of recent press coverage, Iona Capital recently made national news with our most recent venture with Wensleydale Cheese Creamery – famous for the depiction of its cheese in Wallace and Gromit. The contract allows waste whey produced during the cheese making process to be taken away to Leeming Biogas near Northallerton.

The plant, owned and operated by Iona Capital, will then convert the whey into biogas via the process of anaerobic digestion producing enough gas to cover the full energy needs of 800 homes in the local area. The broader implications of these types of arrangements mean that organic by-products generated on a commercial scale which would ordinarily be treated as waste can be utilised to help combat increasing energy needs across the country.

In light of the increasing number of threats associated with climate change and poor waste management, we expect to see a number of these kinds of commercial agreements over the next few years.

See below links to read the full stories:

https://www.bbc.co.uk/news/uk-england-york-north-yorkshire-48662283

https://www.theguardian.com/uk-news/2019/jun/15/wensleydale-cheese-waste-heat-4000-homes-biogas

https://www.insidermedia.com/insider/yorkshire/creamery-deal-to-produce-energy-from-cheese