A new battle plan to defeat Climate Change?

Welcome to our latest Iona Capital Digest. This edition, published to coincide with COP24 taking place in Katowice (Poland), focuses on an alternative approach to better mobilise the resources to tackle climate change, as well as news from the energy and environment sectors and the Iona Capital team.

Iona Capital’s Richard Barker argues whether the global economy now needs to move to the equivalent of a “war footing” to attack climate change……to provide the resources and focus to effectively win the war that is threatening humanity and the planet’s biodiversity.

The publication in October of the IPCC Special Report on Global Warming of 1.5ºC highlighted, once again, both the urgency and scale of the challenge to tackle climate change. But how can we create the necessary political and public awareness and sense of urgency combined with the economic heft to implement the required changes?

Summary of the IPCC Special Report on Global Warming of 1.5ºC

“One of the key messages that comes out very strongly is that we are already seeing the consequences of 1°C of global warming through more extreme weather, rising sea levels and diminishing Arctic sea ice, among other changes,” said Panmao Zhai, Co-Chair of IPCC Working Group 1.

The report highlighted a number of climate change impacts that could be avoided by limiting global warming to 1.5ºC compared to 2ºC, or more.

- For instance, by 2100, global sea level rise would be 10cms lower with global warming of 1.5°C compared with 2°C.

- The likelihood of an Arctic Ocean free of sea ice in summer would be once per century with global warming of 1.5°C, compared with at least once per decade with 2°C.

- Coral reefs would decline by 70-90% with global warming of 1.5°C, whereas virtually all (> 99%) would be lost with 2ºC.

The report finds that limiting global warming to 1.5°C would require “rapid and far-reaching” transitions in land, energy, industry, buildings, transport, and cities. Global net human-caused CO2 emissions would need to fall by about 45% from 2010 levels by 2030, reaching ‘net zero’ around 2050.

This means that any remaining emissions would need to be balanced by removing significant amounts of CO2 from the air. “Limiting warming to 1.5ºC is possible within the laws of chemistry and physics but doing so would require unprecedented changes,” said Jim Skea, Co-Chair of IPCC Working Group III.

Indeed, the report estimates that it will require urgent, large-scale changes from governments, corporates and individuals. It will also need a huge investment of about 2.5% of global GDP each year for the next 20 years.

The history of peacetime democracies, and progress on climate change to date, suggests that implementing these kinds of ‘unprecedented changes’ is virtually impossible in the current geo-eco-political landscape.

Economies in Wartime

I was recently taken by an article in The Times that covered an initiative being pushed by the Women’s Institute (WI). The WI suggested that our impact on the planet can be reduced by a return to ‘thrifty ways’ to reduce the impact of fast fashion on the environment. The article covered characters and slogans (such as “Mrs Sew-and-Sew” and “Make Do and Mend”) that the UK’s Ministry of Information used during the Second World War to encourage people to assist with the war effort.

Economies have managed to rapidly transform themselves in times of war. For example, in World War II, the US economy:

- Raised taxes (the ‘Victory Tax’) which paid for approximately 40% of the war’s costs

- Borrowed money in the form of war bonds and treasuries to cover the rest of the costs.

- Established the War Production Board which awarded defence contracts, allocated scarce resources and persuaded businesses to convert to military production.

This resulted in an estimated 2/3rds of the American economy being integrated into the war effort. The US was producing a staggering 96,000 airplanes a year by 1944 (for comparison, the US Air Force currently flies approximately 5,000 aircraft).

Technology blossomed; when metals became scarce, plastics were developed to take their place. Copper was taken out of pennies and replaced with steel; nickel was removed from nickels.

War-inspired pragmatism even affected fashions: to save material, men’s suits lost their turn-ups and waistcoats, and women painted their legs to take the place of nylons.

This kind of economic focus, cultural shift, technological focus and application of military might – in effect a common purpose – was key to the Allies achieving victory.

The transformation that war economies can achieve makes the changes required and the quantum of the investment needed (2.5% of GDP for 20 years as detailed in the IPCC Special Report) to tackle climate change seem eminently achievable…. if a similar motivation can be found.

Creating an Equivalent ‘War Footing’

Clearly, it is possible for economies to transform rapidly in times of existential threat. However, creating the moral and political conditions to engage in this kind of rapid transformation is not without its challenges:

- Climate change is currently seen as a global war against a seemingly intangible enemy – not defending one’s nation state and people against a ‘demonised’ and identifiable threat.

- The threat is not (yet) seen as a clear and present danger – unlike an army massing on a border, or the bombing of cities.

- The eco-political landscape has changed, with society less tolerant of governments taking greater ‘command and control’, allocating resources and limiting personal choice.

- Similarly, consumers appetite to accept individual ‘sacrifice’ to achieve a higher collective objective has diminished in increasingly consumerist societies.

However, there is good news….

- The IPCC report has been well received and is likely to spur more focussed global policy commitments which the EU and we believe the UK Government will continue to champion.

- Increasing global political consensus: notwithstanding the current US Government’s recidivist climate position, the 2015 Paris Accord has signalled a converging consensus. This multi-national approach (creating ‘allied countries’) is important in waging a global war.

- In many countries, we are now seeing broad multi-party agreement on climate change and the increasing requirement to make meaningful policy changes. This de-politicisation is, in some respects, reminiscent of the types of coalition of political parties seen in some wartime economies (e.g. Churchill’s ‘National Government’ during the Second World War).

- Carbon taxes: Although early days, we are seeing carbon taxes being introduced progressively in multiple jurisdictions. As these increase to meaningful levels, these could be positioned as some kind of ‘Victory Tax’ as in the Second World War.

- Issuance of Green Bonds: as with the “War Bonds” issued in WWII, we are seeing an increasing amount of money focused on funding projects to reduce GHGs. Perhaps these will be marketed in similar ways to retail pension investors.

- Consumer behaviour: we are seeing rapid shifts in consumer behaviour, for example, with respect to plastics and diet (veganism is listed as the UK’s fastest growing social movement). As with some trends seen during wartime, we can expect these to lead to some lasting changes.

- Corporate focus on CSR/ESG: the last decade has seen a significant shift in the corporate sector’s focus on its environmental impact. More needs to be done here, and governments have a clear role in persuading and legislating (but not as drastically as the War Production Board perhaps!).

To emphasise the urgent global need for action, Sir David Attenborough, who was chosen to represent the World’s people at the summit in Poland, told world leaders that ‘The continuation of our civilisation is in your hands… …. If we don’t take action the collapse of our civilisations and the extinction of much of the natural world is on the horizon.’

We are hopeful that thinking is finally changing, but it needs concerted efforts by governments internationally to drive swift global action on climate change.

Sector News in Brief

Government considers incineration tax

In November’s Budget, the Chancellor announced that government is scrutinising the role of incineration in waste management. The Chancellor said incineration played an “important role”, but longer term, recycling should be prioritised and it will in future consider “the introduction of a tax on the incineration of waste, in conjunction with landfill tax, taking account of the possible impacts on local authorities.” The announcement was criticised by the Environmental Services Association (ESA). ESA Executive Director Jacob Hayler said the industry did not want plastic being burnt in Energy from Waste (EfW) plants, but that EfW was a “much-needed alternative to landfill for waste which cannot be recycled […] The Treasury should recognise the valuable role of EfW in putting waste that we cannot recycle to further use, and use tax effectively to target those who manufacture non-recyclable plastic.”

Iona’s Michael Dunn thinks this may well encourage additional investment within the sector. Businesses with high energy use will benefit from £315mn of funding to support their low-carbon transition, while Enhanced Capital Allowances will be extended to companies investing in electric vehicle infrastructure.

Government publishes Bioeconomy Strategy

Originally announced within its Clean Growth Strategy, BEIS has recently published a new Bioeconomy Strategy (2018 to 2030) that assesses the Bioeconomy as a whole, without majoring on bioenergy in particular.

Its new strategy looks across all applications of bio-resources and sets out the Government’s high-level vision of creating a supportive environment that would see the value of the UK Bioeconomy double from £220bn to £440bn by 2030, endorsing the Government’s use of bio-resources as fundamental to the UK’s decarbonisation and economic growth goals.

Green Financing

In November, the Commons Environmental Audit Committee (EAC) published the Government response to its report – Greening Finance: Embedding sustainability in financial decision making. The response showed that the Government and regulators have taken action on the committee’s recommendations to improve pension fund governance, but that Ministers have refused to make climate-related financial disclosures mandatory.

The following EAC recommendations have been accepted by the Government:

The Government has agreed to clarify that trustees have a fiduciary duty to consider long term risk and opportunities, including environmental risks. It is now consulting on amendments to pension scheme regulations that would require trustees to set out how they take account of financially material risks and opportunities including climate change considerations.

The Government says it agrees that it is good practice for pension scheme trustees to inform the design of investment strategies with an understanding of their members. It has consulted on a proposed change to require trustees to set out how they will take account of the views of members in the development of investment policies. Defined contribution pension schemes would also have to publish their statement of investment principles and an annual implementation report describing how the investment policies have been applied, and inform members via their annual benefit statement of where it might be found.

The Financial Conduct Authority is consulting on rule changes that would require the Independent Governance Committees of contract-based pensions to report on how they manage environmental risks and how they take account of members’ ethical concerns.

The Financial Reporting Council has launched a new project to assess how well companies apply best practice identified by investors in reporting on climate change.

The Committee’s original report found that structural incentives across the UK investment chain encourage a focus on short-term returns, often to the neglect of longer-term considerations – including environmental sustainability and climate change-related risks and opportunities.

Iona News Update

Iona’s latest investmentss

In the past quarter, Iona Capital has made four investments

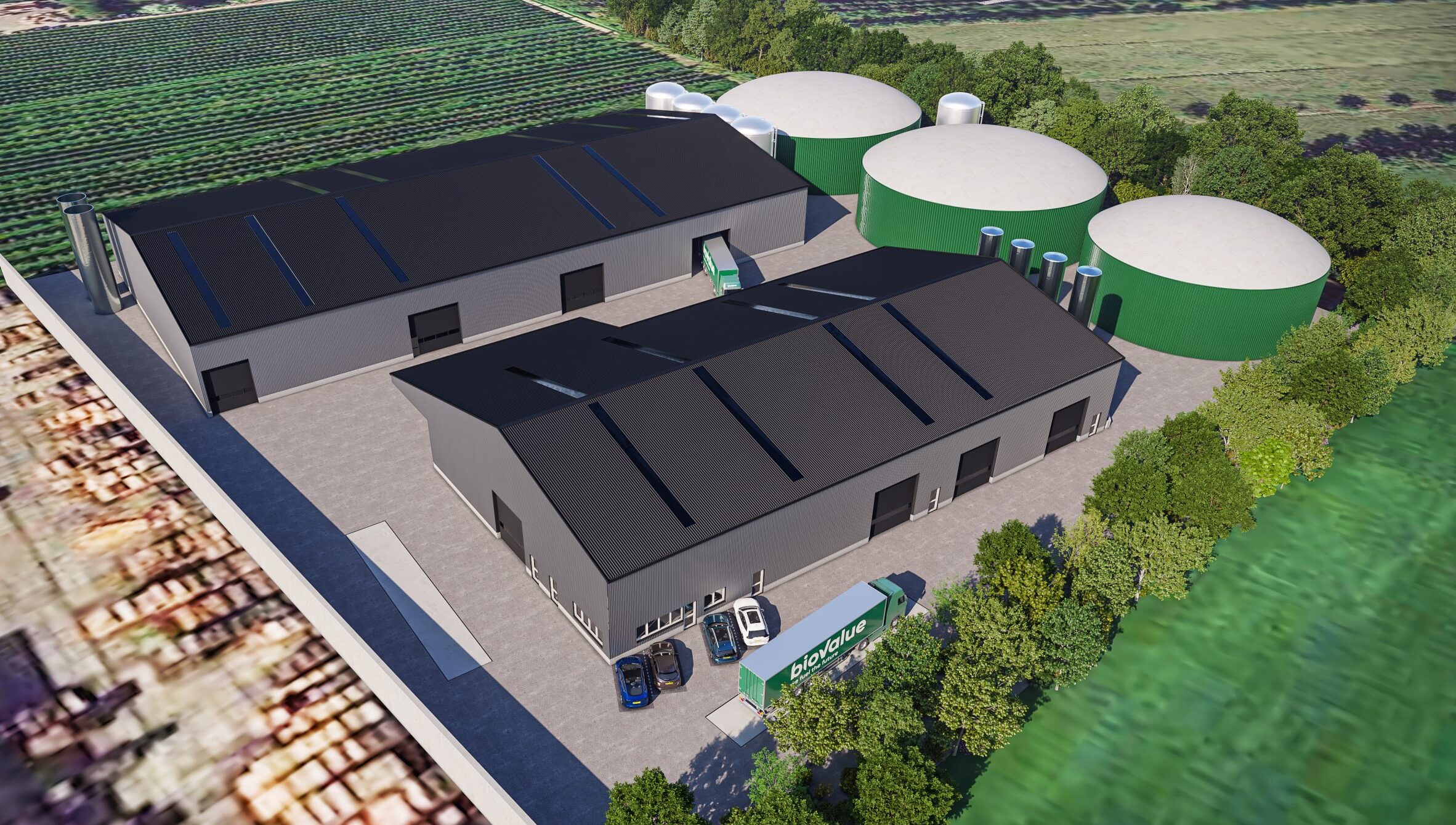

- a £15m investment in a new 8.8MW anaerobic digestion plant, located in south West Scotland. The principal feedstock will be waste slurries generated from local dairy and beef farming operations, underpinning the plant’s compliance with OFGEM’s revised targets on sustainability. The plant will have the capacity to heat circa 7,000 households on an annual basis. It will start commercial operation in late 2019.

Site clearance nears completion at Crofthead whilst tank erection commences

- a co-investment with Equitix of a £72 million Energy from Waste facility in Bridgwater, Somerset. The 7.75MW facility will process approximately 100,000 tonnes of commercial and municipal refuse derived fuel (“RDF”) per annum, which would otherwise have been destined for landfill. Construction will commence next year and the facility should enter commercial operation in 2021.

- a new natural gas Combined Heat and Power energy centre for a long-established precision engineering company located in the West Midlands. The CHP scheme will be built and operated by Iona Capital’s subsidiary, Advantage, based in Pershore, Worcestershire. Advantage provides O&M services to biogas plants and other low carbon assets across the UK.

- an investment into Haworth ASL Limited, a joint venture company with Agritec Systems Limited to build and operate a new animal by-products processing facility, co-located with one of the UK’s leading chicken abattoirs. It will process all of the abattoir’s CAT3 material under a long-term supply contract.

Commenting on these investments, Nick Ross of Iona Capital said: “Iona’s bioenergy projects will provide attractive commercial returns to our investors and our business partners, as well bring long term social, environmental and economic benefit”

Also, Iona Capital has been investigating a range of novel technologies to increase the efficiency of agricultural anaerobic digestion (AD) plants across our portfolio and allow for greater feedstock flexibility. We have undertaken the first full scale UK trials of two technologies which have the potential to lead to more rapid biogas production, improved biogas production, increased efficiency and additional feedstock flexibility. Trials have been ongoing across two of our sites throughout 2018, and will draw to a close very soon.