Welcome to Iona’s fourth digest, which focuses on investment in sustainable infastructure, as well as news from the energy/environment sector and the Iona Capital team.

Iona Capital’s Richard Barker writes on the challenge of investing in the world’s new sustainable energy infastructure to keep within the 2°C global warming limit agreed in Paris in 2015.

It is estimated that energy production and usage accounts for approximately 2/3rds of all greenhouse gas (GHG) emissions globally. To have any chance of staying within the 2°C global warming threshold agreed at the 2015 Paris Agreement, the world’s energy and transport systems will have to be re-imagined, re-invented and rebuilt … and quickly.

In the UK, the Government is looking to address this challenge, inter alia, with BEIS’s Clean Growth Strategy, DEFRA’s Air Quality Strategy and the Department of Transport’s just published Road to Zero strategy. However, is Government action enough?

The Challenge

The next twenty years will be critical in determining the success of our attempts to build the new sustainable international economy. We can either lock in ‘conventional’ energy infrastructure and designs that expose us to future commodity price volatility, exacerbate local pollution and maintain high levels of GHG emissions, or we can invest in more efficient, less polluting, more flexible energy systems that will deliver a dramatic reduction in GHG emissions.

Investment into energy infrastructure presents both the largest opportunity and the largest challenge that face our governments, legislators, investors and banks. Globally, it is estimated that $23 trillion will need to be invested into energy supply and generation, and $24 trillion across transport and energy consumption (including energy efficiency) over the next 15 years.

Where will this investment come from?

The Role of Institutional Investors in Infrastructure

The traditional investors in energy infrastructure are:

- National and regional governments

- Development insitutions (e.g. African Development Bank, EBRD, World Bank)

- Corporates (both public and private), and

- Project Finance (both Public Private Sector Partnerships and non-PPP)

Although the assets under management of institutional investors has grown significantly over the last twenty years (see graph below), their role in infrastructure investment has historically been vanishingly small. Indeed, estimates suggest they account for between 1% – 5% of all infrastructure investment.

Assets under Management of Non-Bank Institutional Investors, 2001-2013

Source: Delivering of Sustainable Infrastructure for Better Development and Better Climate, December 2016, New Climate Economy

Given that institutional investors now account for the largest pool of capital globally, their role is critical in delivering the funding required for investment into this new sustainable infrastructure.

The investors and the markets need to develop the capacity and structures to channel a growing proportion of institutional investors’ funds into sustainable infrastructure.

A Changing Infrastructure Landscape: “Patchwork Quilt” Energy

The growth in renewable energy infrastructure is seeing a movement away from large centralised energy generation (nuclear, coal and gas fired powered stations) towards a ‘patchwork quilt’ involving a mixture of centralised sources of power (major hydro, wind and solar) and transmission, and a broader distributed energy landscape that incorporates localised generation, transmission and back up.

The traditional approach to funding centralised energy infrastructure – project finance – is often ill-suited to the smaller distributed energy projects. The nature of security, contracted cashflows and legal documentation are all different in decentralised projects – as is government’s ability to mandate/sponsor ‘blue riband’ pieces of infrastructure such as Hinkley Point C and Swansea Bay tidal lagoon.

Transition from Funding Centralised Energy infrastructure to Distributed Energy Infrastructure

This then poses two questions to the traditional funders of energy infrastructure:

1. Will traditional funding structures preclude energy infastructure investors from investing in the new decentralised energy infastructure?

<>2. How must the industry evolve to ensure that sufficient funds will be made available to fund the necessary transition to a decentralised low carbon future?The Opportunity for Specialist Private Equity Funds

The twin challenge of encouraging institutional investor funds into sustainable infrastructure and the impact of distributed energy on the relevance of traditional project finance structures will fall to a new breed of fund manager such as Iona Capital.

Iona Capital, through its experience in investing in smaller scale energy projects over the last seven years, has developed a strong understanding of the drivers in this evolving marketplace. It is clear that the traditional project finance structures are often not applicable or suitable to a significant number of smaller energy projects in which Iona has been involved. Iona’s ability to evaluate and manage projects to yield attractive risk adjusted returns is becoming increasingly important in this new distributed world.

To conclude, Iona welcomes the opportunities that this new sustainable energy infrastructure challenge presents, and is well positioned to deploy funds that will deliver attractive risk-adjusted returns for its fund investors.

Sector News from UK & abroad

National Infrastructure Assessment published

In its first National Infrastructure Assessment of the UK (published July 10th), the National Infrastructure Commission has called on the Government to increase the proportion of UK’s electricity generated from renewable sources from the current level of 30% to 50% by 2030. The NIC said the switch to greener energy can be accomplished without increasing bills, concluding that renewable energy and balancing technologies would be comparable to new nuclear power plants and cheaper than implementing carbon capture and storage with the existing generation system.

It recommended that the Government should agree support for no more than one nuclear power station beyond Hinkley before the middle of the 2020s. It finds that moving to an electricity system mainly powered by renewable energy sources could be the “safest bet” for generation, although the report acknowledges that natural gas will play a role over the short term. The Government is obliged to respond to the Commission’s report within the next 12 months, ideally within six months. The NIC report made recommendations on energy but also the waste, water, transport and digital sectors. A link to the full report: www.nic.org.uk/assessment/national-infrastructure-assessment/

Green Finance Select Committee Report

In May, the Commons Environmental Audit Committee published its report into Green Finance. The cross-party group of MPs said that BEIS’s Clean Growth Strategy was light on detail and called on Ministers to publish a plan to secure the investment needed to meet the UK’s carbon budgets after a series of Government policy changes have contributed to a slow-down in clean energy investment. The EAC reported that annual investment in clean energy is now at its lowest since 2008 and said that privatisation of the Green Investment Bank and a reduction in European Investment Bank lending following the Brexit referendum may also have played a part in the fall in investment. Among its list of recommendations, the Committee said that ministers should find new ways to support local councils to mobilise investment in low carbon projects. A link to the full report: www.parliament.uk/business/committees/committees-a-z/commons-select/environmental-audit-committee/news-parliament-2017/green-finance-report-published-17-19/

Enel’s Lithium-Ion Battery Plan for Russian Railways

Italian energy giant Enel plans to install 10-megawatt-hour batteries on Russian railways to help trains move more quickly and smoothly along the rail network. The move to create what was termed as a “first-of-its-kind innovative storage system” will allow the Russian rail network to accommodate bigger and faster trains without spending money on grid upgrades, Enel said.

The Mysterious Demise of Africa’s Oldest Trees

Baobabs are some of the most distinct and revered trees in Africa, living for hundreds, often thousands, of years and containing up to 500 cubic meters of wood. But scientists have discovered that an alarming number of these trees are dying — and they don’t know exactly why.

According to a new study published in the journal Nature Plant, nine out of Africa’s 13 oldest baobabs, and five of the six largest, have died over the past 12 years. Although the researchers don’t have a definitive reason for the deaths, they suspect a changing climate is playing a role, particularly Africa’s hotter, drier conditions in recent decades.

Iona Capital News

At the UK AD & World Biogas Expo 2018 ( held on 11/12 July at NEC Birmingham):

- Iona Capital’s Alex Todhunter won the “Rising Star” award in this year’s awards ceremony

- Richard Barker gave two well-received speeches at the Expo: “How to get the most from your AD plant” and “Finding help to build on-farm AD plants”

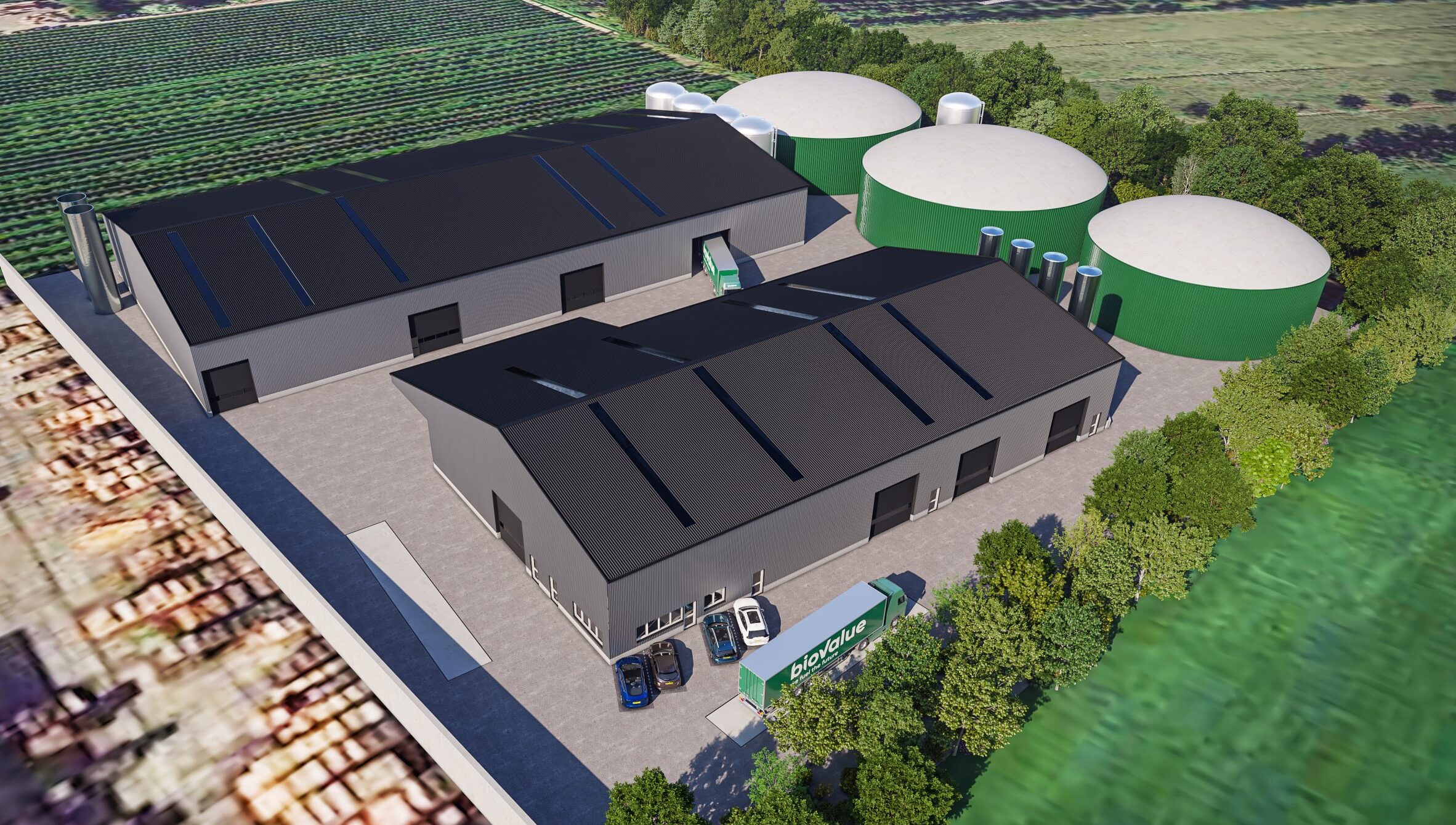

Iona’s Whitchurch Biogas project in Shropshire has been shortlisted for a 2018 REA Award.

Iona Capital’s Mike Dunn will be speaking on Green Financing at the RWM Conference on 12/13 September 2018 at the NEC in Birmingham:

In May 2018, Richard Barker spoke at the TEDx London Business School event with a thought-provoking talk titled “What the Abolition of Slavery teaches us about Climate Change.”

Finally, this is an exceptionally busy summer period for Iona, and we expect to be closing on a number of transactions with announcements to follow in Q3 2018.