Welcome to the second issue of the Iona Digest. In the last issue, we covered the big picture driving the climate change and environmental investment agenda. In this issue, we will be looking at developments in the climate change arena and also at the critical leadership role that we believe pension funds are taking on behalf of their members in climate change.

Al Gore’s Climate Leadership Corps – and the latest developments in the climate change debate

Richard Barker,

Adviser and Investment Committee Member

In June, I participated in the most recent Climate Leadership Corps event which is led by former US Vice-President Al Gore. The objective of the Climate Leadership Corps is to train people from around the world to raise understanding of climate change at a grassroots level within communities, town halls and city/state/regional governments in order to create action and change from the bottom up. In the 11 years since the programme started, approximately 12,000 Climate Leaders from over 60 countries have been through the training.

The key messages from the latest event can be summarised in five bullet points:

- Climate data and the latest scientific research demonstrate that the impacts of climate change are greater and faster than anticipated only 10 years ago;

- The technical advancement (and cost reduction) in renewable energy and low carbon technologies has been much more dramatic than previously projected;

- Investment into and deployment of renewable energy has increased by orders of magnitude above the levels predicted;

- In spite of the positive momentum established by the 2015 Paris Agreement, governments around the world are struggling to mobilise both collectively and quickly to pursue the actions to reduce greenhouse gas emissions that climate science states are required;

- Whilst the majority of people now believe that climate change is mainly caused by man-made emissions, there is uncertainty and some despair as to how individuals can make a positive impact on what is a truly global scale issue.

Why are we seeing the pension fund industry beginning to take on a leadership role in climate change and investing through fund managers such as Iona Capital?

What does the average person want from their pension investments? A clear priority is to provide the means for a comfortable retirement. However, both consciously and unconsciously, we also each wish to leave some kind of legacy for our spouse, children and grandchildren. That legacy is not defined solely in terms of a financial inheritance, but includes concepts of the kind of future world (incorporating environmental, and societal considerations) in which our children and grandchildren can thrive. Looking at financial performance first, there is increasing evidence that there is a strong linkage between a company’s focus on sustainability and financial performance. In a meta-study of over 200 research reports, over 80% of the studies showed that share price performance of companies was positively influenced by good sustainability practices. We believe that this positive correlation will be increasingly seen across multiple asset classes. Secondly, a poll earlier this year by ComRes for the Energy and Climate Information Unit (ECIU) revealed that there had been a “discernible shift” in public opinion with 64% agreeing that climate change is happening and is mainly caused by human activity. This was up from 59% when the same question was asked in 2015 and up from 57% in 2014.

The UK is at a point now with its attitude to climate change that is approaching the kind of 2/3rds super-majority that transcends political tribalism. This same shift is also being seen in many countries around the world. If we look at the opt-in/opt-out debate in organ donation which shows that in countries which have an ‘opt-out’ policy to organ donation (ie people have to choose not to donate), more than 90% of people typically donate; we can learn important lessons about the psychology of pension funds asking their members to ‘opt-in’ to ethical investments vs taking leadership on behalf of their members. An ‘opt-out’ approach to sustainability investing and an assurance that all investments are made based on Environmental, Social and Governance (ESG) principles would surely deliver results to the super-majority of their members. The power that the pensions industry yields would allow its investors to gain financial returns (which are increasingly correlated to sustainable investments) and leave the ‘non-financial’ legacy that the majority are searching for. Pension funds are increasingly looking to move beyond the traditional approach to ESG investing to a broader strategic view of the impacts of, inter alia, climate change on their portfolios. We see pension funds incorporating a range of approaches when establishing a strategic view of ESG/climate change investment:

- Investment allocation: Carving out a percentage allocation to climate change investment. This in itself could be in the form of infrastructure style investment into solar/wind assets, or investment into Venture Capital and Private Equity in climate change technologies and companies etc. A strategic question is how much should this allocation be, how should this be determined and deployed;

- Scorecard: Including a specific ESG/climate change scorecard for all the funds/investments it makes. This forces fund managers to explicitly develop and articulate their approach to ESG/climate change;

- Sectoral risk analysis: Several sectors are seeing dramatic changes in the context of the strengthening sustainability agenda. Forward looking scenario analysis can reveal sectoral risks and portfolio rebalancing. An example would be the potential current overvaluation of international oil and gas companies – on the basis that current reserves are over-valued and the possibility of future legislative risk in the context of the rush to renewable energy;

- Sectoral opportunity analysis: As above, several sectors are looking at the mega trend opportunities that are emerging in the climate change arena. For example, using the ‘selling shovels in the gold rush’ analogy, the potential to invest in JCB/Caterpillar etc. because of the increased demand for new build and repairs to, inter alia, coastal flood defences;

- Country & political risk analysis: Longer term country risk/political assessment related to government bonds, insurance and forex exposures. For example, the projected marginalisation of North African agricultural sectors due to climate change and secondary migration impacts on Italian politics.

The unique position of the local authority pension funds

In the context of the above, local authority pension funds are perhaps uniquely positioned in that they are very close to the majority of their members by virtue of their geographical catchment areas. This means that the pension funds can have a very direct impact on their members’ legacies within their regions by weighting their investments to within their regions. As a result, Local Authority Pension Funds could establish fund allocations which are not only cognisant of the global risks and opportunities of climate change, but also help drive positive regional environment and social outcomes as part of their investment strategies

SECTOR HIGHLIGHTS

Energy capacity auctions shows offshore wind taking the lion share of the awards with strike pricing for two major projects (2.3GWh) at £57.5 per megawatt hour outstripping nuclear at £92.5 per megawatt hour in CfD auctions. Biomass with dedicated CHP had limited success with a strike price of £74.75 and a mere 85 megawatt hours. A feature of the market is the reducing depency on tariff incentives to achieve project closes. Electric Hybrids – UK and France announce sales of petrol and diesel cars are to be banned from 2040, while a bank predicted all new car sales in Europe would be electric five years before that. Uber followed up announcing that all their cars will be electric or plug in hybrid by 2025.

FURTHER THOUGHTS

Modern buildings with large expanses of glass or mirrored surfaces are potentially dangerous for bats research suggests as reported by the New Scientist.

IONA NEWS

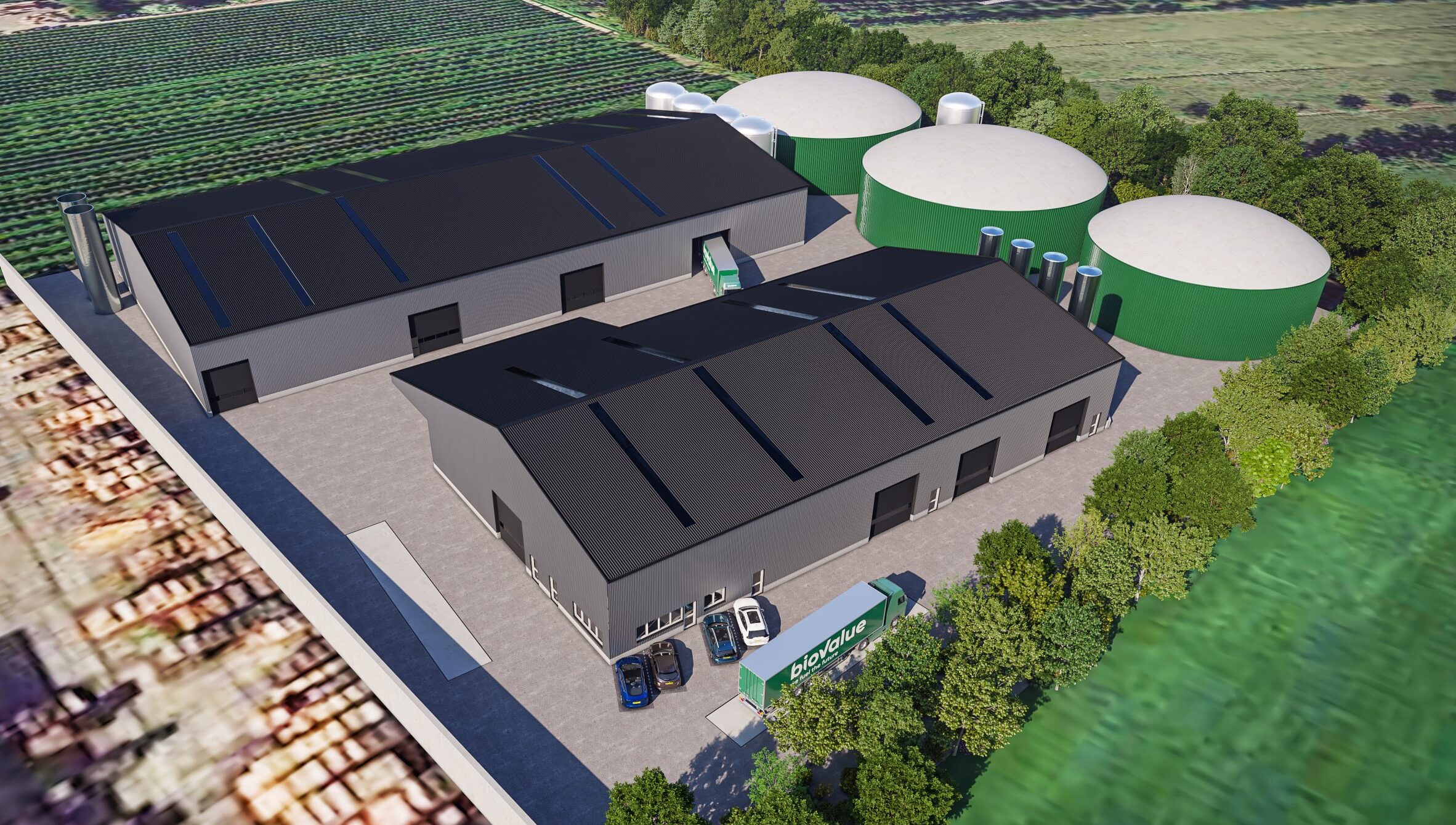

Peter Mills currently Managing Director of Panda (UK) will join us in October as Director of Operations responsible for asset performance. Peter has considerable experinece of composting, AD and MBT technologies having previously held relevant positions within the Veoila Group. Peter began his career at the Environment Agency.

WHERE WE WILL BE

R30th November: Stuart Gordon Investment Director, will be speaking at the Sustainable Waste Management Conference in Edinburgh on Market Funding Innovations