Welcome to the Iona Digest. We start our first issue by looking at the big picture driving the climate change and environmental investment agenda.

The world is warming up (according to the chart below) and the key Government response has been to try to limit global temperature rises to less than 2.0% of pre industrial temperatures by 2030 through a policy of decarbonisation. This has driven a huge investment into renewable energy and the phasing out of coal based power stations.

The effect of this structural change was in evidence when National Grid reported that at lunchtime on the 7th June 2017, for the first time in excess of 50% of the UK’s electricity needs were met by power from wind, solar, hydro and wood pellets. With the addition of nuclear, at 2pm this reached 72.1%.

However despite some positive indicators, the Committee on Climate Change Report published in June 2017 is clear that ‘progress will not continue without new policies’.

The Carbon Reduction Framework: What is happening?

The New Scientist in its 8th April edition reported CO2 levels are likely to reach a 50 Million tonnes high by 2050. There is scientific evidence that this is causing long term impacts to the climate through temperature increases and therefore has formed the backdrop which has driven the CO2 reduction agenda. The fiscal frameworks of choice to remedy the problem are either to tax goods and services on the basis of how much carbon dioxide is emitted during production – a carbon tax or to impose a limit on how much CO2 can be emitted by industry and then sell permits to pollute, cap and trade or carbon trading. The cap and trade approach was enshrined in the COP21 Paris Agreement 2016 treaty which has legal force in the UK and is further being endorsed by large financial institutions, multinational and NGO signatories of the agreement in a recent call to adopt certain ‘carbon pricing corridors‘.

But if this stalls, as is significantly more likely given the US Government’s current attitude towards climate change then it is likely that pressure will revert to a tariff mechanism to reduce carbon emissions. Many argue that to the extent this is deemed fair and reasonable then this will be allowed under WTO rules and a trade war at least drawn on this particular issue is unlikely, but this is an area of uncertainty and we will return to this in subsequent editions, when Richard Barker, who sits on our Investment Committee will give his thoughts having recently attended Al Gore’s Climate Reality Leadership Conference in Seattle.

How does it affect investment?

What does this all mean for the UK environmental infrastructure investor. In the short to medium term we think very little. The UK is still bound by its EU legislative framework in particular the Renewable Energy Directive (2209/28/EC) and the Climate Change Act 2008. Most industry insiders do not see changes to the EU driven framework which was strongly influenced by the UK and it is expected that it will be adopted into UK law post Brexit. We will look at the circular economy in a future edition for a further example of UK driven initiatives which are part of EU law. Tariff support will of course reduce over time and or be refocussed, while it can be argued that policies will no longer favour novel technologies, seeCfD auction pooling.

However, the lack of capital in the £5M -£30M bioenergy infrastructure space means there will still be a strong pipeline of projects with abnormally high returns over the next five year investment horizon. Thus as a class of investment, the bioenergy sector remains buoyant for the informed investor.

SECTOR HIGHLIGHTS

The shift to cleaner power is disrupting entire industries, has the revolution arrived? It is worth watching the recent video by the FT- The Green Big Bang, to get the latest perspectives.

Al Gore hosted the Climate Reality Leadership Conference trailing the sequel to the 2006 film, An Inconvenient Truth, conveniently named ‘An Inconvenient Sequel’ which will be released on 12 August 2017. This will argue that the impact of climate change is faster than originally projected however, adoption of technologies has also been faster than predicted. Political will, however still needs to be much stronger.

FURTHER THOUGHTS

Meeting Carbon Budgets: Closing the policy gap 2017 Report to Parliament Committee on Climate Change published June 2017 stated:

“The Government must publish plans to meet the fourth and fifth carbon budgets without further delay”.

And on a lighter note, the Economist explained on July 2nd ‘How fracking leads to babies’. While Europe struggles with more earnest ways of cutting emissions, it seems that in the US, the unpopular method of fracking has had a positive side effect.

IONA NEWS

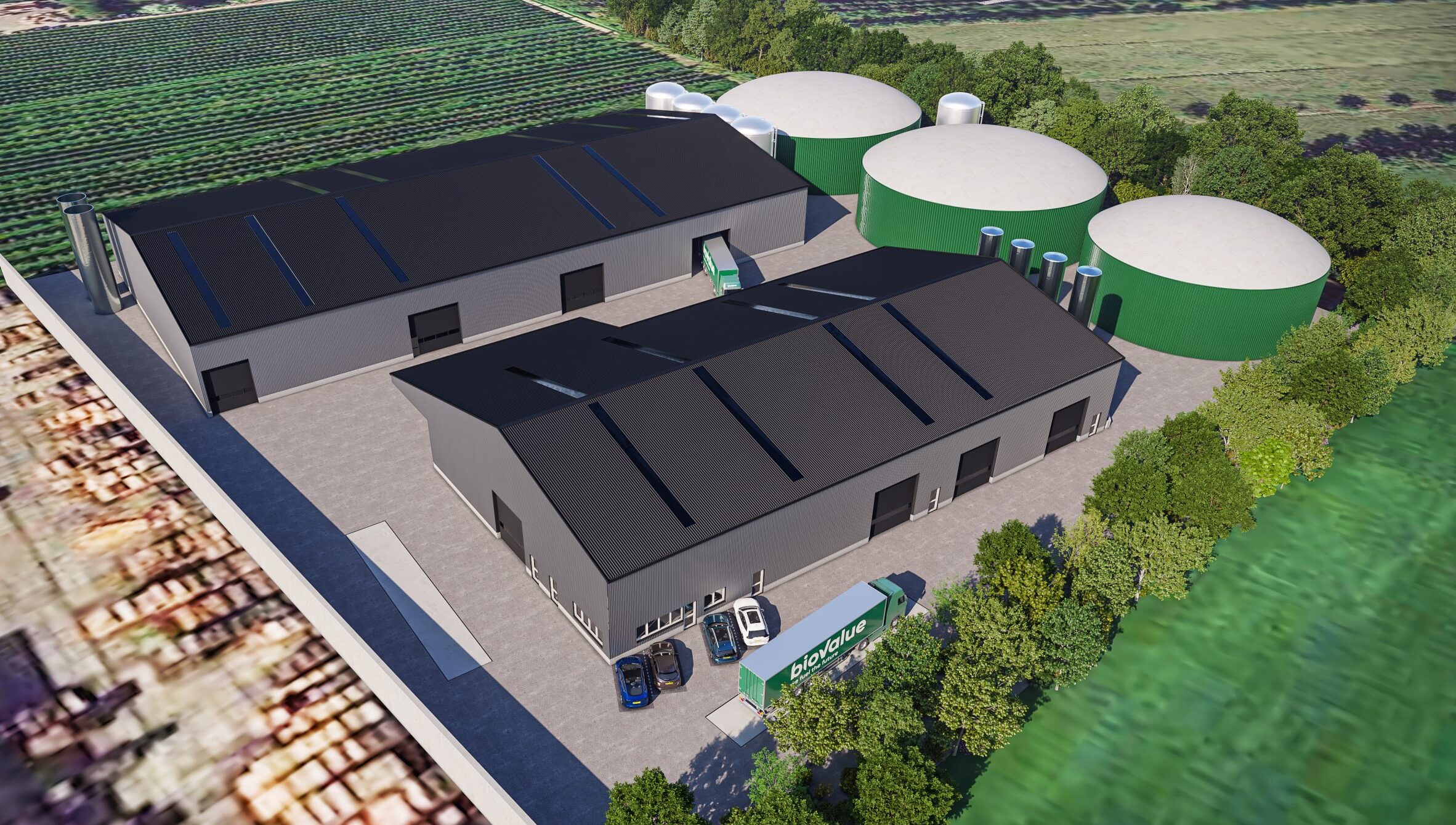

Iona’s Brocklesby project will be opening in September. The plant will generate 3.5MW of electricity, which will be delivered directly to the national grid and will also produce heat, which will be utilised by the surrounding businesses. One of the by-products will a bio-fertiliser that will be distributed on farm land.

Iona is raising a fourth fund after interest from non-UK investors in the UK bioenergy sector.

WHERE WE WILL BE 12/09: Recycling and Waste Management Dinner, Birmingham 28/09: Scottish Resources Conference, Mike Dunn speaking on the ‘Future of Managing Resources’