Iona Capital, the UK renewable energy investment specialist, is launching a £10m Environmental VCT to fund waste-to-energy projects, principally focusing on Anaerobic Digestion. The fund offers retail investors the potential for strong tax-free returns and a reduction in income tax bills while providing direct access to a low risk portfolio of Government endorsed waste recycling and renewable energy generation solutions.

The UK Government has set demanding waste reduction targets for local authorities and the publication of DEFRA’s Anaerobic Digestion Strategy report earlier this year identifies Anaerobic Digestion as a proven, lower risk technology to meet these targets.

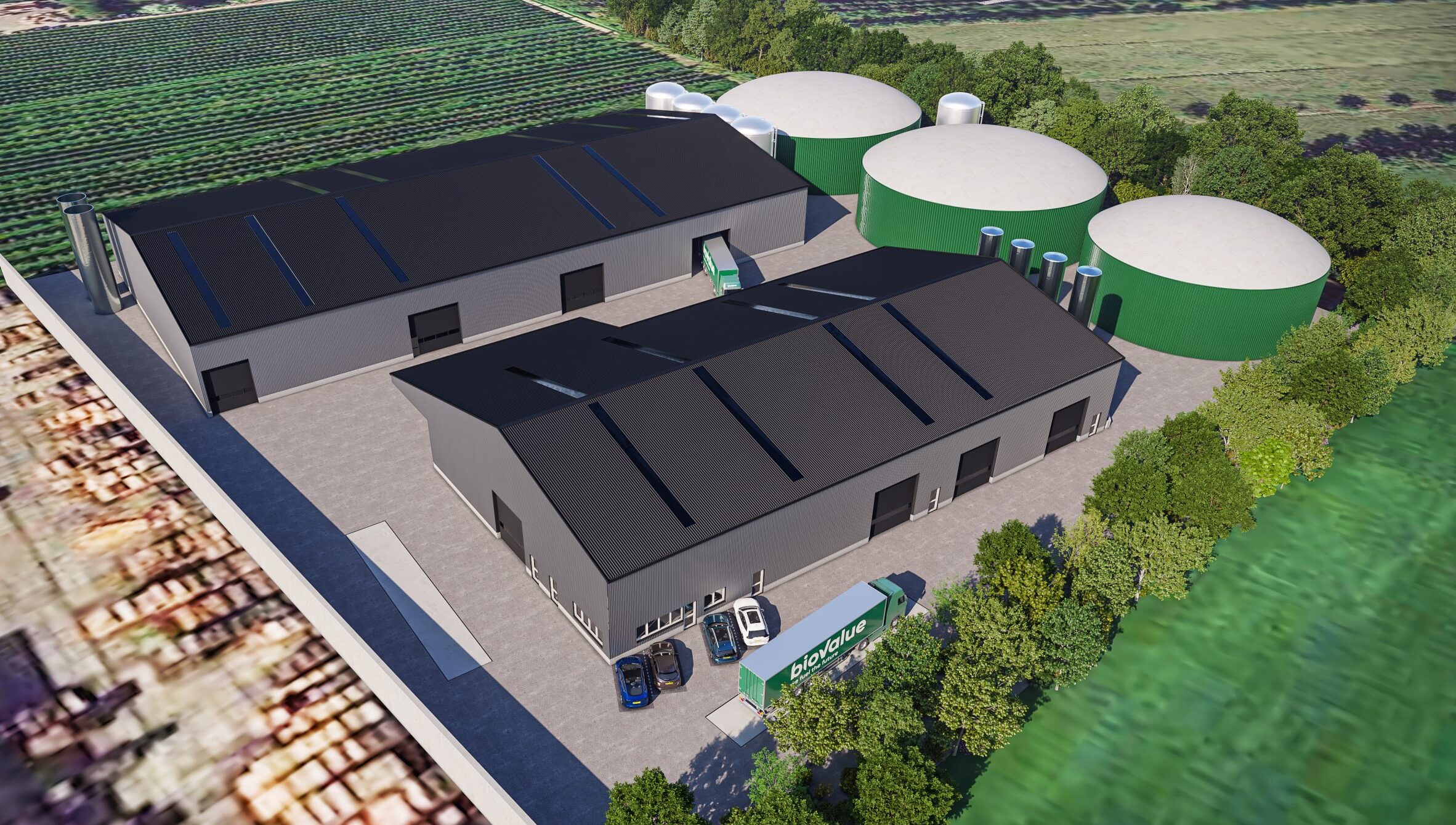

Anaerobic digestion is a biological process that happens naturally when bacteria breaks down organic matter in environments with little or no oxygen. Benefits include the production of a digestate that can be used as a liquid biofertilizer and a biogas that can be burned to produce electricity. Over 3bn of Government funding has been identified to meet the demand for waste-to-energy facilities in the next ten years.

Iona Capital is currently working with BiogenGreenfinch, the UK award-winning builder and operator of Anaerobic Digestion plants, on a number of contracts targeting local authorities across Wales. Investment is currently being completed into 3 plants, with a further 4 anticipated each year. Each plant takes approximately 9 months to build and commission.

Mike Dunn, Iona Capital’s Managing Partner, said:

“Recent government initiatives and enhancements in anaerobic digestion technologies have created significant opportunities for retail investors. The fund has also been structured to maximise the potential to generate strong returns for investors in a tax efficient way. Partnering with BiogenGreenfinch also offers the added confidence of working with a leading organic waste recycling supplier”

Commenting on the partnership Richard Barker, CEO BiogenGreenfinch, said:

“Iona Capital brings a strong understanding of the Anaerobic Digestion model, the UK waste sector and local authority procurement processes. This, together with their collaborative and practical approach to delivering a robust funding solution have made them a good partner to deal with.”

Investment will typically be through a combination of secured debt and equity, targeting a tax-free yield of 10% p.a. and the return of capital in years four to six. Each investment is backed by long term supply contracts with local authorities and larger corporate entities.

Iona Capital has established a pipeline of potential investment opportunities of approximately 10 waste-to-energy plants and is seeking £10million from retail investors. An anaerobic digestion plant derives its revenue from electricity production, the sale of biofertilizer and gate fees. Government incentives such as Feed-in-Tarrifs (FITs) and Renewable Heat Incentives (RHIs) also apply.