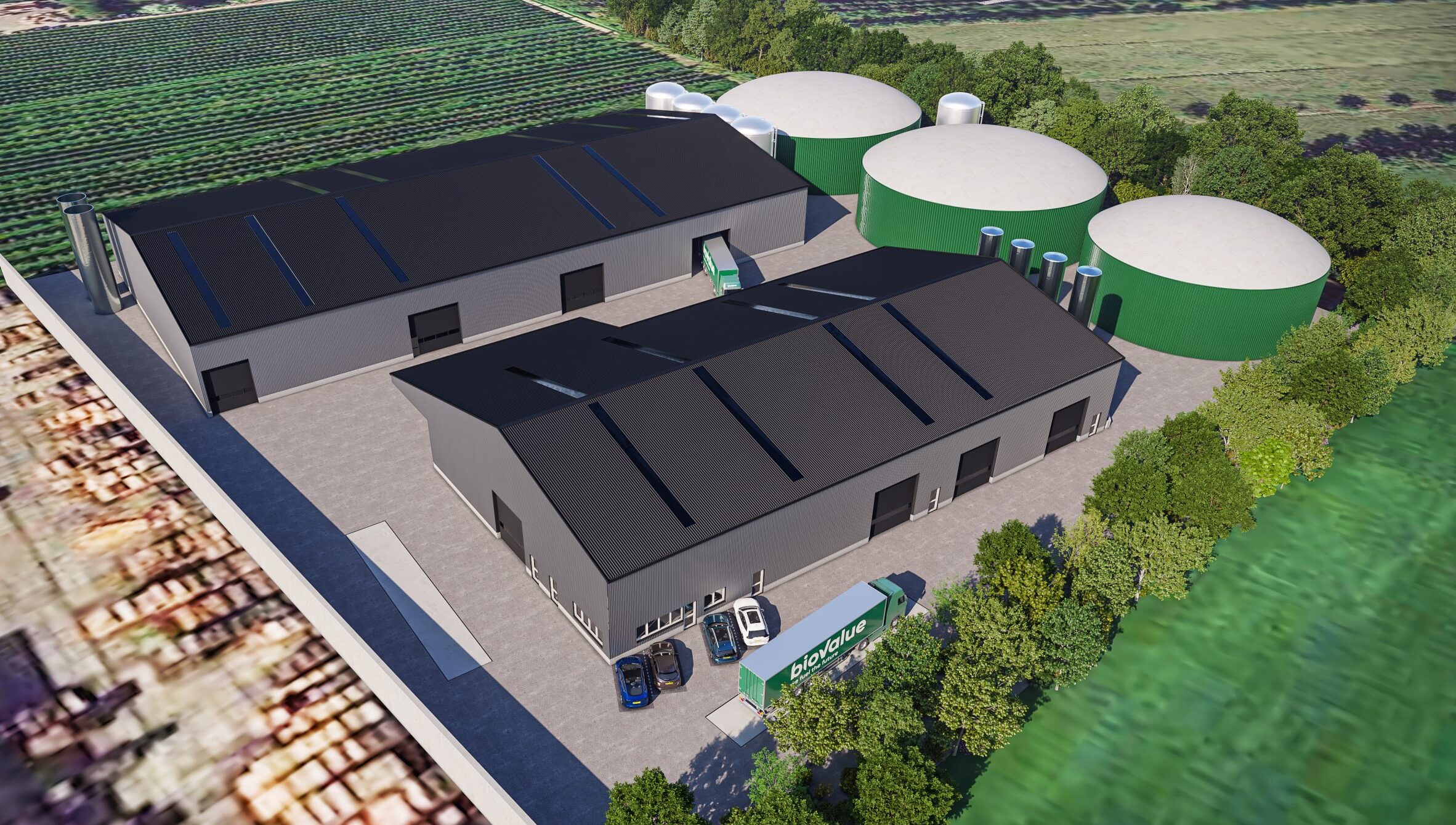

On 12th and 13th of September, the Iona Capital Team converged from all over the country on the RWM trade show to network, and meet project developers and technology providers. This show is attended by developers operating across most sectors where Iona Capital invests; from anaerobic digestion to manage organic waste, through the burgeoning smaller scale Energy from Waste energy recovery sector to reduce the climate impact of landfilling, to smaller, niche waste management technologies. The latter bolt on to existing operational processes to either generate private wire heat and power, or manage difficult waste streams to produce profitable by products.

These themes were neatly summarised by one of our Directors, Mike Dunn, and our Investment Committee Adviser, Richard Barker in their joint presentation on day 2 of the conference. Whilst much of the emphasis on tackling climate change is focused on power, heat and transport, there are huge potential Carbon Savings, and associated efficiencies available through the careful movement of materials up the waste hierarchy after they have come out of industrial processes.

Since the turn of the millennium, there has been a sharp change in the long term trend in raw materials prices. These had fallen steadily over the course of the 20th Century as technical and business processes became ever more efficient. However, from the late 1990s onwards, the price of raw materials has been rising steeply. Consequently there huge savings which businesses can make by reusing, recycling and recovering energy from the waste materials from industrial processes. Iona Capital is able fund specialist technologies which can reduce businesses material, waste handling and energy costs. This will mitigate resource cost increases, enhance environmental performance, and create new business opportunities.

Government policy such as the clean growth strategy is recognising and reinforcing these realities, but it is apparent that we are at a cross roads where infrastructure investment will either lock in conventional business models, energy and resource infrastructure and designs; the alternative is to use finance to deliver more efficient, less polluting and more flexible energy and resource systems that will deliver savings in costs and green house gas emissions.